NYFA Student Health Insurance Plan (NYFASHIP) and Requirements

NOTE: To ensure compliance with NYFA’s policy of mandated health insurance coverage, NYFA automatically enrolls and bills all One-Year, Two-Year, AFA, BA, BFA, MA and MFA students in the NYFA Student Health Insurance Plan (NYFASHIP).

NYFASHIP is a comprehensive insurance plan provided through Aetna, a nationwide provider of health insurance plans and services. NYFASHIP provides benefits and coverage for preventive, routine, emergency, specialty, inpatient, and outpatient medical and psychological care, as well as medications prescribed by an in-state provider.

NYFASHIP provides students annual health insurance coverage, August-August. Plan benefits include:

- Unlimited maximum benefits

- No pre-existing conditions exclusions

- Individual deductible per policy per year: $250 in-network; $500 out-of-network

- Individual combined out of pocket maximum of $3000 per policy year

- Co-insurance: 80% in network, 60% out of network with no internal maximums

- Preventative care and wellness benefits

- Inpatient and outpatient services for medical, behavioral health and substance abuse treatments

- Prescription drug coverage

For a comprehensive list of services covered by NYFASHIP, as well as a complete list of plan exclusions, please click here to access the Plan Design and Benefits Summary for your campus.

NYFA Student Health Insurance Requirements

Healthcare in the U.S is exceptionally costly. Having health insurance offers one protection from undue financial burden related to the expense of pharmaceuticals, and routine and emergency medical and mental health care. Without adequate health insurance coverage, medical and mental health emergencies can be financially devastating.

NYFA requires all students attending long-term programs to purchase and maintain health insurance coverage for the duration of their time attending their NYFA programs.

NYFA strongly recommends all students attending short-term programs to purchase health insurance plans that are active for the duration of their programs.

Workshop/ Short-Term Students: NYFA strongly recommends all Workshop/Short Term students to purchase health insurance coverage for the time they are residing in the U.S. and participating in their program. Students are advised to carefully read the benefits summaries for the short-term health insurance plans they are considering for purchase and attend closely to each plan’s exclusions for coverage. Many travel insurance plans are very affordable, yet they do not, for example, cover expenses related to pre-existing conditions. Travel insurance plans also typically do not cover expenses related to the treatment of mental health conditions or any medical services needed if injured while engaging in risky behaviors, as defined by the health insurance carrier. Students are advised to purchase the health insurance plan that is not only affordable, but best aligned with their lifestyle, their tolerance of risk, and most importantly, their medical and mental health care needs.

Degree and Conservatory/Long-Term Students : To ensure compliance with NYFA’s policy of mandated health insurance coverage for long-term students, , NYFA automatically enrolls and bills all 1-Year, 2-Year, AFA, BA, BFA, MA, and MFA students in the NYFA Student Health Insurance Plan (NYFASHIP). For all students attending long term programs, costs for student health insurance coverage will be billed to students’ accounts at the start of each term enrollment period.

All long-term NYFA students remain enrolled in NYFASHIP throughout their program duration, and are responsible for paying the health insurance fees billed to their accounts, from the time of program registration and for the subsequent terms in which they remain enrolled in their academic programs.

Students who prefer to have and maintain alternative health insurance coverage may submit, each year or at designated times during the year, depending on program start dates, an application to waive out of NYFASHIP and dis-enroll from NYFASHIP coverage.

To dis-enroll from NYFASHIP, students must submit proof of comparable health insurance coverage by participating in the waiver application process. To effectively and continuously dis-enroll from NYFASHIP throughout program duration, students must successfully participate in the waiver application process at the time of program registration and for subsequent Fall(s)/August(s), for as long as they remain NYFA students.

NYFASHIP Terms of Enrollment

Students enrolled in NYFASHIP will receive health insurance coverage through NYFASHIP for the term enrollment periods spanning the time of program registration through Fall/August of the subsequent year. Fees for insurance coverage per each term enrollment will be billed to student accounts throughout their period of coverage. Students beginning programs in Fall/August will be billed for Fall, Spring, and Summer terms of coverage (unless program graduation dates occur before the start dates of summer term enrollment). Students beginning programs in Spring/January will be billed for Spring and Summer terms of coverage. Students beginning programs in Summer/May will be billed for the Summer terms of coverage. All students continuing in their programs beyond August will be automatically enrolled in NYFASHIP for the coming academic year (August-August) unless they dis-enroll from NYFASHIP for the coming year(s), through successful participation in the waiver application process.

Enrollment in NYFASHIP may be canceled if and only if: 1) a student’s waiver application has been approved; 2) a student has graduated from a NYFA program; and 3) a student has withdrawn or been dismissed from a NYFA program.

Upon graduation, leave of absence or withdrawal from a NYFA program, students will retain their insurance coverage until the term’s end date. Graduated students and students who withdraw from their programs for reasons unrelated to illness are not eligible to renew NYFASHIP enrollment for subsequent terms. Students taking an approved leave of absence or withdrawing from the college for reasons related to illness, as substantiated by medical documentation, may extend their insurance coverage for one year beyond the end date of their current term of coverage by contacting Aetna directly and requesting continuation of coverage.

Enrollment

To Register with Aetna, access your Aetna ID Card, and/or enroll dependents/spouses:

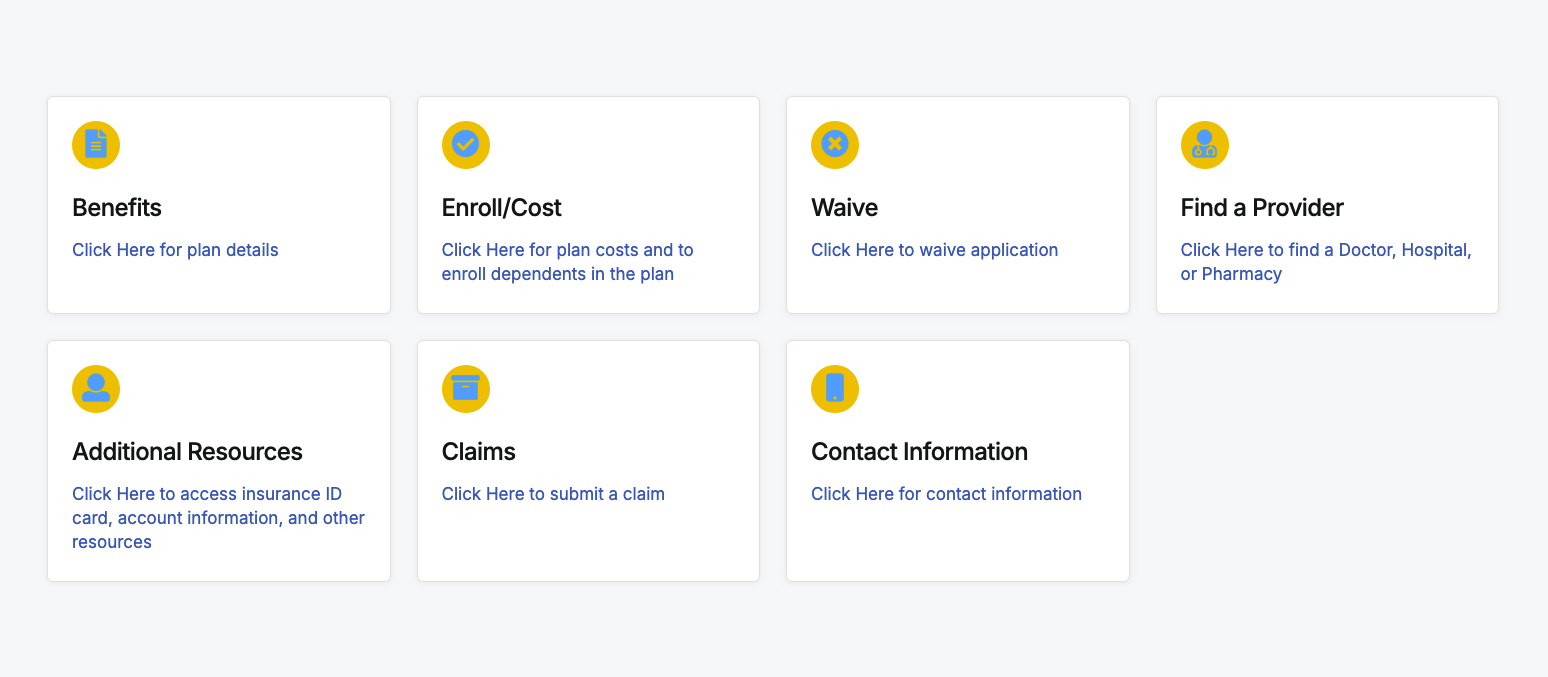

Aetna is the health insurance carrier through NYFASHIP. NYFASHIP is administered through Academic HealthPlans (AHP). AHP manages the websites, enrollment, and waiver processes. Use the link below to access your health insurance plan. To access your Aetna ID Card, go to “Additional Resources” on the Home page. To enroll dependents/spouses, go to “Enroll Dependents” on the Home page.

NYFA Student Health Insurance Plan – New York Campus

Enrollment FAQ’s

Why do I even need health insurance? I rarely need to go to a doctor. If I get a flu, cold, sinus infection or one of the other common medical ailments, can’t I just go to the college’s Student Health Center for free and immediate care?

NYFA does not have a Student Health Center on any of its campuses. Students needing medical attention of any kind will need to contact an off-campus doctor’s office or clinic to schedule an appointment and receive the care they need. Should students need medical documentation to justify absences, students will need to request documentation from an off-campus physician or health care professional. It is in the students’ best interest to have health insurance to offset the costs of outpatient office visits. In the US, costs to evaluate and treat even minor illnesses and injuries can be very high!

If you have a chronic condition (a physical illness or a mental illness), any treatment you may need to manage your illness will be covered by NYFASHIP. If you choose to purchase an insurance plan other than NYFASHIP, unless your plan covers pre-existing conditions, your health insurance will not cover any of the expenses you incur related to the treatment of your chronic condition.

Can’t I get the care I need for my mental illness at NYFA Counseling Services?

Yes, but NYFA Counseling Services may not be able to meet all of your mental health needs. NYFA Counseling Services, on NY, LA, and SB campuses, are staffed by psychologists and/or master’s level providers. Our mental health care providers do not prescribe medication. Students needing prescriptions for medications treating depression, anxiety, ADHD, personality disorders, etc., will need to seek psychiatric services off campus. Please know that psychiatrists in private practice may charge $350 or more for each office visit. However, with the NYFA Student Health Insurance Plan, students can meet with an in-network psychiatrist and pay only $40 per visit.

Also, NYFA Counseling Services offer short- term psychotherapy only. Students needing weekly and ongoing psychotherapy will be referred, carefully and appropriately to off campus, private mental health care providers. Without adequate health insurance coverage, each visit with a mental health care provider will cost approximately $150-$250. With the NYFA Student Health Insurance Plan, students will be charged approximately $20 per visit with an in- network psychotherapist.

What happens if I leave NYFA before the term of my health insurance coverage ends?

If you withdraw from the program within 31 days of the first day of classes of your first semester, you will be dis-enrolled from NYFASHIP, and your coverage will be terminated. Fees for term coverage will be removed or refunded unless claims for health care services received have already been filed and/or paid.

Students who graduate from a NYFA program before the end of a NYFASHIP term enrollment period will be covered by NYFASHIP until the term’s end. Students who leave their NYFA program after the 31-day grace period but before the end of a NYFASHIP term enrollment period will be covered by NYFASHIP until the term’s end.

Requests for termination of insurance coverage before the end of your NYFASHIP enrollment plan will be decided on a case-by-case basis. Factors considered in granting or denying your request will include the timing of the termination request, number and nature of claims already submitted and paid during the current enrollment period, and the reason for withdrawal from your NYFA program.

For Questions/Assistance: HealthInsurance@nyfa.edu

How can I find out what specific treatments or services are covered?

For a comprehensive list of services covered by NYFASHIP, as well as a complete list of plan exclusions, please click the link below and go to “Explore the Plan” to learn more about the plan benefits.

Does NYFASHIP cover treatment outside of the state where I am enrolled in classes- FL, CA, or NY?

Yes. NYFASHIP provides coverage in all 50 states, U.S. territories and foreign countries. For students studying in Los Angeles and South Beach, non-US citizens are not covered in their home country if their home country offers socialized medicine.

Are prescription drugs covered on this plan?

Yes, prescription drugs are covered. Prescriptions dispensed through a preferred care pharmacy will be paid at 100% of negotiated charges following a $10 copayment for each 30-day supply of a generic prescription drug (Tier 1), a $20 copayment for each 30-day supply of a preferred brand name prescription drug (Tier 2) and a $40 copayment for each 30-day supply of a non-preferred prescription drug.

Cost & Claims

What is the cost of the NYFA Student Health Insurance Plan?

The costs that will be automatically billed to your account each semester of your program include the term premiums for the insurance plan, underwritten and provided through Aetna, and a small per term NYFA administrative fee. You will be billed for insurance coverage costs at the start of each term enrollment period. For most NYFA long-term programs, term enrollment periods coincide with the start of each semester. For semesters that span two enrollment periods, or approximately 32 weeks, students will be billed for each enrollment period and, hence, twice during the duration of an approximate 32-week-long semester.

Health insurance costs are also called premiums. Premiums are predetermined costs paid to the insurance company on a monthly, semi-annual, or annual basis for insurance coverage. Please refer to the NYFASHIP cost breakdown below for the 2024-2025 academic year. Another common cost associated with Aetna’s Student Health Policy is the $250 in-network deductible or $500 out-of-network deductible per policy year. A deductible is a predetermined amount of money the member is required to pay for covered services before your health insurance carrier begins to pay. Deductibles are common in health insurance plans and apply to a majority of healthcare services.

NYFASHIP RATES FOR 2024 – 2025

NEW YORK CAMPUS

New Students, Students Returning After an Extended Leave, and Continuing Students Not Previously Enrolled in NYFASHIP:

| Annual (8/31/2024- 8/30/2025) |

Fall (8/18/2024- 01/04/2025) |

Spring (01/05/2025- 05/03/2025) |

Summer (05/04/2025- 8/30/2025) |

| $2668.34 | $980.82 | $843.76 | $843.76 |

*Rates DO NOT include term premiums and a NYFA administrative fee ($105/per academic year or $35 per term.)

Continuing Students currently Enrolled In NYFASHIP

| Annual (8/31/2024- 8/30/2025) |

Fall (8/31/2024- 1/4/2025) |

Spring (1/05/2025- 5/3/2025) |

Summer (5/4/2025- 8/30/2025) |

| $2588.00 | $900.48 | $843.76 | $843.76 |

*Rates DO NOT include term premiums and a NYFA administrative fee ($105/per academic year or $35 per term.)

Can I purchase coverage for dependents through NYFASHIP?

Yes. Coverage for spouses/domestic partners and children can be purchased through the website below. Go to “Enroll Dependents” on the Home Page to learn more.

Whom do I contact should I have questions about my plan or claims I have submitted?

For questions related to NYFASHIP, go to the website below. Go to the “Chat” function at the bottom of the Home Page, or go to “Contact Information” for assistance. If you need additional help, click help.ahpcare.com or email healthinsurance@nyfa.edu.

Where can I find my claims and medical bills?

You will find your claims and medical bills directly with Aetna. You can access this information two ways.

- You can view your claims through NYAF AHP website by going to https://nyfa-ny.myahpcare.com/ and click on the Claims Button:

- You can also view your claims directly through your account with Aetna. You can view previous and current medical claims along with the associated Explanation of Benefits documents (EOBs). An Explanation of Benefits (EOBs) is a document insurance companies send to the policyholder, explaining the charges for a corresponding medical service. With Aetna’s Student Health Insurance Plan, these can be found with the “Claims” tab within your Aetna account. You can also file claims by uploading medical bills and submitting them to Aetna. Aetna uses a secure messaging system to communicate with you regarding billing and/or any sensitive personal information.

How do I obtain tax information regarding my health insurance coverage?

To obtain tax information regarding your health insurance coverage, you will login directly to the Aetna Member website.

-

- Select “Profile”.

- Select “Secure Settings” to verify your Social Security Number (SSN)

- Select “Letters & Communications” and you should see and be able to print your 1095B.

Continuation and Termination of Coverage

Can I continue my NYFASHIP coverage if I leave my program?

Yes, you may purchase continued coverage if and only if you are leaving your program AND you have been approved for a Leave of Absence or a Voluntary Medical Leave of Absence. If you qualify, in order to continue your coverage, you will purchase directly through AHP by going to https://nyfa-ny.myahpcare.com/enrollment and click on Approved Leave Of Absence to purchase. You will purchase per term basis, for a maximum of three consecutive terms of health insurance coverage (the equivalent of one year of coverage beyond the expiration of your current term of coverage).

I am graduating soon and I have applied for OPT. How can I continue my existing coverage so that I will have health insurance after graduation and during my OPT?

Yes! Students who successfully completed their programs and were previously enrolled in NYFASHIP and eligible for OPT may extend their insurance coverage for one year beyond the end date of their current term of coverage by purchasing directly through AHP by going to https://nyfa-ny.myahpcare.com/enrollment and clicking on “Students Preparing for OPT.” Students who successfully completed their programs and are not eligible for OPT are unable to renew NYFASHIP enrollment for subsequent terms.

You will be able to purchase continued coverage for up to one year post graduation. You will need to submit a request for continued coverage at https://nyfa-ny.myahpcare.com/enrollment for each term (fall, spring, summer) for which you want coverage.

Students taking an approved Leave of Absence or a Voluntary Medical Leave of Absence, may also extend their insurance coverage for one year beyond the end date of their current term of coverage by going to https://nyfa-ny.myahpcare.com/enrollment and choosing the “Approved Leave of Absence” option.

How to login and enroll while on OPT:

Use the link below to access the enrollment system. You need your NYFA Student email to login. After selecting “Enroll”, select “Optional Practical Training (OPT)”. Click here for the Student Experience Guide to assist with enrollment questions. If you need additional assistance, go to the “Chat” function at the bottom of the Home Page, or go to “Contact Information” for assistance.